After a period of growth, the latest data from HMRC suggests that the housing market is slowing. Whether this is a temporary blip or is likely to become a long-term trend is unclear. That means it is important to analyse the many factors that have contributed to this slow-down and consider the likelihood of them continuing.

December statistics

This data comes from the UK monthly property transactions statistics for December 2022. These show that, without seasonal adjustments, residential property transactions were down 3% from November 2022 and 1% from the same time the previous year. Seasonal adjustment changes this to 1% higher compared to the previous December. For non-residential transactions, the figures are 9% and 5% when not seasonally adjusted, or 3% and 1% with seasonal adjustments.

Ongoing impact of the pandemic

The pandemic caused just about everything to slow down if not completely close, and whilst most industries are emerging from their covid-related restrictions, the impact is still being felt. One of the biggest differences to the housing market was the temporary reduction in stamp duty, helping support the industry and make sales a little easier. Transactions are a little higher now than they were before the pandemic began in 2019, although remaining below 2021-22 figures.

Increasing mortgage rates

Everything has become more expensive recently due to inflation, including mortgage rates. This means a combination of mortgages becoming less affordable and people having less to spend generally. There is a significant cost of buying, including expenditure such as the homebuyers survey cost seen here: https://www.samconveyancing.co.uk/news/house-survey/homebuyers-survey-cost-9958. This clearly leads to a reduction in the number of people looking to buy properties. It has taken until now to see the impact of higher mortgage rates because of the time a property transaction takes to reach completion.

New regulations

One thing that will impact house sales in the immediate future is the passing of new regulations regarding energy efficiency in commercial properties. Some companies will refurbish and renovate, but others will choose to move to more modern and efficient premises that do not require as much work. This could lead to some small movements in the market.

Digitisation

Digitisation is an ongoing trend across all aspects of life. In the context of the property market, this affects builders, estate agents, solicitors, sellers and buyers; changing the planning process, how records are kept, methods of communication and, in some cases, even automating certain processes. Done properly, this could save time and money, therefore making property transactions easier and quicker.

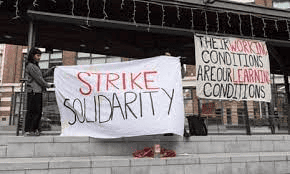

Strike action

Like many industries, strike action has affected the property market. In particular, the Land Registry is going on strike in February, which will almost certainly cause further delays and disruption.

Current statistics only cover a limited time period, so it is impossible to know for sure if current trends will continue. It does appear, however, that slow but steady is the current direction of travel for property transactions, in contrast to the more frantic action earlier in 2021.